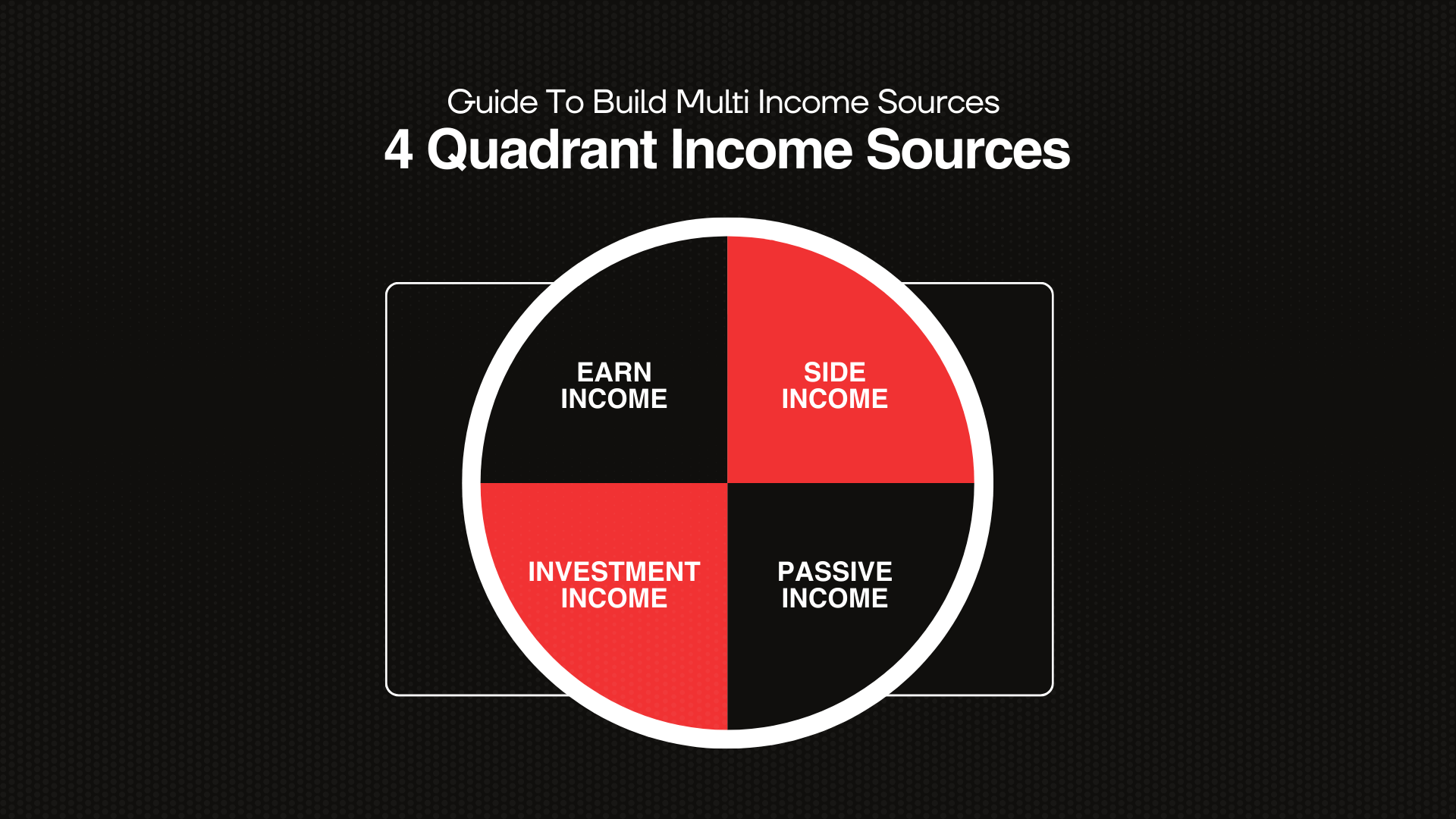

In today’s dynamic economy, relying on a single income stream can leave you vulnerable to unexpected challenges. By understanding and leveraging the four quadrant income model , you can build a resilient financial portfolio that combines active effort with passive growth. Let’s break down each quadrant and explore how they work together to create stability and freedom.

Quadrant 1: Earned Income – Trading Time for Money

Earned income is the foundation of most people’s financial lives. It involves exchanging your time and skills directly for compensation, such as salaries, wages, or freelance payments.

- Key Traits :Requires consistent effort; income stops when you stop working.Examples: Full-time jobs, part-time roles, or gig work (e.g., Uber, tutoring).Provides immediate cash flow but offers limited scalability.

While earned income is essential for covering daily expenses, it’s crucial to recognize its limitations. To build wealth, use this quadrant to fund ventures in other areas.

Quadrant 2: Side Income – Monetizing Extra Time

Side income, or side hustles, allows you to leverage hobbies, skills, or spare time to generate additional earnings. Unlike earned income, this quadrant offers flexibility and creativity.

- Key Traits :Examples: Selling handmade products, freelance writing, affiliate marketing, or rental income from assets like cars or equipment.Requires active effort but aligns with personal interests.Can evolve into a full-time business or supplement other income streams.

Side hustles not only boost your earnings but also help you explore passions that might one day become primary sources of revenue.

Quadrant 3: Investment Income – Growing Wealth with Capital

Investment income involves using money to generate returns through strategic allocations. This quadrant focuses on long-term growth and requires patience and education.

- Key Traits :Examples: Stock dividends, real estate rentals, peer-to-peer lending, or interest from savings accounts.Requires upfront capital and research but minimal ongoing effort.Benefits from compounding, where returns generate additional earnings over time.

Successful investors prioritize diversification—spreading funds across assets like stocks, bonds, or property—to mitigate risk and maximize growth.

Quadrant 4: Passive Income – Building Automated Systems

Passive income is the ultimate goal for financial independence. It involves creating systems, products, or assets that generate revenue with little to no daily involvement.

- Key Traits :Examples: Royalties from books or music, automated online businesses, franchising, or subscription-based services.High initial effort to design systems (e.g., writing an e-book or launching a course).Scalable and sustainable once established.

While building passive income demands significant upfront work, the long-term payoff is unmatched. It allows you to earn while focusing on other priorities.

How to Combine the Four Quadrants for Success

- Start with Earned Income : Use your primary job to build savings and fund side projects or investments.

- Experiment with Side Hustles : Test low-risk ideas to diversify skills and income.

- Invest Strategically : Allocate funds to assets that align with your risk tolerance and goals.

- Build Passive Systems : Dedicate time to creating automated revenue streams for long-term freedom.

Conclusion

The four quadrants—Earned, Side, Investment, and Passive Income—offer a roadmap to financial resilience. By diversifying across these categories, you reduce reliance on any single source and unlock opportunities for growth. Whether you’re working a 9-to-5 job, launching a side project, or designing passive systems, the key is to start small, stay consistent, and prioritize learning.